Organizations that handle payment card data must ensure their security measures are not just in place – but effective. The Payment Card Industry Data Security Standard (PCI DSS) outlines a stringent set of security requirements for protecting cardholder information, and one of its most critical components is penetration testing.

The full transition to PCI DSS v4.0.1 took effect in March 2025, making updated testing requirements mandatory. The new version emphasizes risk-based testing approaches, stronger validation of segmentation controls, and clearer guidelines for test methodologies and qualifications. As per the official PCI guidance, penetration testing can be conducted by qualified internal staff or third-party specialists, provided they are organizationally independent.

Comprehensive overview of what PCI DSS penetration testing entails in 2025 – from understanding the regulatory requirements to implementing best practices for planning, execution, remediation, and documentation.

What is PCI DSS?

Payment data inefficiencies and fraud on the rise, over 500 payment card brands face major threats due to the lack of proper security measures. On-Site Security has contributed significantly by educating businesses on credit card assessment and transaction security frameworks. PCI DSS compliance is one of the most important elements to consider while operating such businesses.

For a ground‑up explanation of PCI DSS compliance and its scope, see our article What is PCI DSS Compliance?.

American Express, in particular, places strong emphasis on security compliance, allowing them to closely monitor business operations. Smaller businesses are also vulnerable unless they implement strong protective measures. From an engineering perspective, enhanced defense strategies have tackled the tough problems involved in protecting critical cardholder data.

Why PCI DSS compliance is critical in 2025

The implementation of PCI DSS version 4.0, with its over 50 new and updated controls, demands a heightened focus on compliance in 2025. Introduces a shift toward continuous, outcome-based security. With the rise in digital payments, online shopping, and sophisticated cyber-attacks, payment card information is more vulnerable than ever.

Key reasons why compliance is critical this year:

- Stringent new requirements: PCI DSS 4.0 now includes annual scope definition, automated detection of payment page execution, web application monitoring, and advanced encryption protocols.

- Expanded third-party risk: Organizations must ensure that each vendor and partner handling card data complies with PCI DSS 4.0.

- Severe consequences for non-compliance: Failing to comply with PCI DSS can lead to hefty fines, legal actions, loss of payment processing privileges, and serious reputational damage.

- Continuous compliance culture: The new standard promotes ongoing risk assessments and proactive security efforts – shifting from annual audits to a culture of continuous improvement.

The role of penetration testing in PCI DSS compliance

Penetration testing is essential to meeting PCI DSS standards. It involves executing simulated attacks on systems, networks, and applications to uncover vulnerabilities that could be exploited by malicious actors.

PCI DSS 4.0 makes these requirements more rigorous:

- Internal and external testing: Both must be conducted at least annually and after any significant change to the cardholder data environment (CDE).

- Segmentation validation: If network segmentation is used to reduce PCI scope, its effectiveness must be tested to ensure proper isolation of payment systems.

- Industry-standard methodologies: Testing must align with frameworks such as NIST SP 800-115, OWASP, or PTES.

What readers will learn from this guide

By following this comprehensive guide, readers will gain:

- A clear understanding of PCI DSS and its goals – who needs to comply and why it matters in 2025.

- Insight into the updated PCI DSS 4.0 requirements, including advanced controls, continuous compliance expectations, and third-party risk management.

- An overview of the role of penetration testing in PCI DSS, including methodologies, scope, timing, and reporting requirements.

- Practical steps to achieve compliance – from scoping and risk assessments to remediation and audit preparation.

Understanding PCI DSS Requirements

The Payment Card Industry Data Security Standard (PCI DSS) is a global framework designed to help businesses protect cardholder data and prevent security breaches. Applicable to all organizations that store, process, or transmit payment information, PCI DSS outlines 12 core requirements covering areas like network security, access control, and system monitoring. With PCI DSS v4.0 enforcement approaching in 2025, it’s critical to understand the framework – especially Requirement 11, which focuses on regular testing.

Overview of PCI DSS framework

The PCI DSS framework, developed by the Payment Card Industry Security Standards Council (PCI SSC), applies to all organizations handling cardholder data from major card brands like Visa, MasterCard, American Express, Discover, and JCB. It consists of 12 core requirements, grouped into six control objectives aimed at securing payment data from end to end.

The 12 PCI DSS Requirements:

- Install and maintain a firewall configuration to protect cardholder data.

- Do not use vendor-supplied defaults for system passwords and other security parameters.

- Protect stored cardholder data.

- Encrypt transmission of cardholder data across open, public networks.

- Protect all systems against malware and regularly update anti-virus software.

Requirement 11: Regular Testing – What it says about pen tests

Requirement 11 is a critical component of PCI DSS, emphasizing the need for ongoing assessments of system security to detect and address vulnerabilities before they can be exploited.

Key Aspects of Requirement 11:

- 11.2: Vulnerability Scans – Organizations must perform internal and external vulnerability scans at least quarterly and after any significant change (e.g., new system deployment or major software update).

- 11.3: Penetration Testing – A penetration test must be conducted at least annually and after significant changes to the environment. This test simulates real-world cyberattacks to identify exploitable weaknesses.

- Segmentation Testing – If network segmentation is used to isolate the Cardholder Data Environment (CDE), tests must validate the effectiveness of the segmentation controls.

- Qualified Testers – Tests must be conducted by individuals or organizations with demonstrable expertise – either internal staff with no direct responsibility for system security or external third parties.

Difference between vulnerability scanning and penetration testing under PCI DSS

Although both are vital components of Requirement 11, vulnerability scanning and penetration testing serve different purposes and should not be confused.

Vulnerability Scanning:

- Definition: Automated process to identify known vulnerabilities such as outdated software, missing patches, and misconfigurations.

- Tools Used: Tools like Qualys, Nessus, OpenVAS.

- Frequency: At least quarterly and after significant changes.

- Scope: Internal and external systems within the cardholder data environment.

- Performed By: Internal staff or Approved Scanning Vendors (ASVs).

Penetration Testing:

- Definition: Manual or hybrid testing simulating real-world attacks to exploit vulnerabilities and assess their impact on the organization.

- Tools Used: Burp Suite, Metasploit, Nmap, manual techniques.

- Frequency: At least annually and after major environment changes.

- Scope: Entire cardholder data environment and systems connected to it.

- Performed By: Qualified internal staff (with no CDE responsibilities) or third-party experts.

What Is PCI DSS Penetration Testing?

PCI DSS penetration testing is a simulated cyberattack carried out to identify and exploit potential vulnerabilities within an organization’s systems that store, process, or transmit cardholder data. It is a mandatory requirement under Requirement 11.3 of the PCI DSS framework and is essential for validating the effectiveness of an organization’s security controls.

Testing helps organizations evaluate their security posture, verify segmentation controls (if used to isolate the Cardholder Data Environment), and uncover any weaknesses that could lead to a data breach. If network segmentation is used to reduce PCI scope, segmentation testing is mandatory to validate its effectiveness.

Definition and Scope

Penetration testing, also known as pen testing, is the process of simulating real-world cyberattacks to identify exploitable vulnerabilities in your IT environment. It’s not just about detecting weaknesses – it’s about actively testing whether those weaknesses can be exploited by an attacker to access or impact systems.

According to Requirement 11.3 of PCI DSS, pen testing must cover:

- External and internal network components

- Systems inside and outside the Cardholder Data Environment (CDE)

- Critical systems that support the security of the CDE

- Application-layer vulnerabilities (e.g., SQL injection, XSS)

Internal vs. external penetration testing

External Penetration Testing:

- Targets public-facing assets accessible from the internet (e.g., web applications, servers, APIs).

- Simulates attacks from outside the organization to uncover risks that an external attacker might exploit.

Internal Penetration Testing:

- Focuses on internal networks, systems, and applications within the CDE.

- Identifies threats from malicious insiders or attackers who have already breached the outer defenses.

Segmentation Testing Requirements

Network segmentation is used to isolate the CDE from other organizational networks, reducing PCI scope and potential risk. Segmentation testing is required to:

- Verify that segmentation controls effectively block unauthorized access to the CDE.

- Ensure strict separation between CDE and non-CDE systems.

- Validate all segmentation methods after any significant change and at least annually.

Frequency – How often pen tests must be done

PCI DSS mandates that penetration testing be performed:

- At least once a year on both external and internal assets.

- After any significant infrastructure or application change (such as changes in network topology, addition/removal of systems, or updates to segmentation controls).

- Segmentation testing (for service providers) must be performed every six months, and after any changes to segmentation controls.

When to Conduct PCI DSS Penetration Tests

As part of an organization’s compliance strategy for the Payment Card Industry Data Security Standard (PCI DSS), penetration testing is especially important for identifying weak spots that could be exploited by bad actors. Some of the new cardholder data (CHD) systems that may require testing include alternate systems, network changes, large patch implementations, and new software applications that store, process, or transmit CHD.

The required instance testing, elevated risk, and constant change all call for heightened vigilance. Rapid DevOps, cloud deployments, and third-party services necessitate more frequent testing. The same level of vigilance applies in dynamic, high-impact environments due to automated testing workflows.

Key triggers: new systems, significant changes, new threats

- New Systems: Whenever a new system or application is integrated into the cardholder data environment (CDE), a penetration test is required to identify any vulnerabilities these additions may introduce.

- Significant Changes: PCI DSS specifically mandates a penetration test after significant changes to the environment. These include major upgrades, infrastructure modifications, the addition of new sub-networks or web servers, or changes to network segmentation.

- New Threats: If new vulnerabilities or attack vectors are discovered in the industry (such as zero-day exploits), or if your organization experiences a security incident, immediate penetration testing is recommended to assess exposure and defenses.

Recommended Annual and Bi-annual timelines

- Annual Penetration Testing: At a minimum, both internal and external penetration tests must be conducted at least once per year to remain PCI DSS compliant.

- Bi-Annual (Every Six Months) Segmentation Testing: Entities that use network segmentation must conduct segmentation testing at least every six months. This ensures segmentation controls reliably isolate the CDE from other networks over time.

Aligning with quarterly Vulnerability Scans

- Quarterly Vulnerability Scans: PCI DSS also requires external vulnerability scans every quarter and after significant changes. While these scans are less comprehensive than penetration tests, they play a complementary role by detecting a broad range of known weaknesses on a regular basis.

- Strategic Alignment: Use the results of quarterly scans to prioritize areas for deeper examination during annual or bi-annual penetration tests. This ensures that newly discovered vulnerabilities or high-risk systems are proactively addressed.

How to Prepare for a PCI DSS Penetration Test

The PCI DSS penetration test is essential for meeting compliance requirements and improving your organization’s security posture. For businesses that deal with cardholder data, PCI DSS requires that penetration testing be done annually or after major modifications to the network environment.

Begin by defining the boundaries of the test with respect to the cardholder data environment (CDE). It is also critical to ensure all relevant systems, applications, and networks are accurately identified. Failing to act during the pretest phase does not bode well – ensure there is no junk data in system documentation, all vulnerabilities are patched, and monitoring and logging systems are functioning properly.

Scope and Boundaries

This includes identifying all systems, networks, applications, and endpoints that store, process, or transmit cardholder data. The defined scope should also include any connected systems that might impact the security of the CDE to ensure comprehensive coverage.

- Include both internal and external systems.

- Verify inclusion of remote access vectors (VPN, dial-up, and similar connections).

- If segmentation is used, ensure controls separating the CDE from other networks are covered in the test.

Identify systems in Scope (cardholder data environment)

Create a detailed inventory of all CDE assets:

- Hardware: Servers, desktops, network devices, mobile devices.

- Applications: Payment processing systems, web and mobile apps, APIs.

- Data Flows: Paths by which cardholder data travels through systems.

- People & Processes: User groups and administrative workflows that interact with card data.

Engage qualified Penetration testers

Engage qualified and independent penetration testers who understand PCI DSS requirements:

- Testers may be internal (but organizationally independent) or a reputable third party.

- Ensure the testers have experience with payment infrastructure, PCI DSS standards, and current attack techniques.

- Validate independence: Individuals responsible for daily CDE management should not conduct or oversee the penetration test.

Develop a test plan and obtain approvals

Work collaboratively to develop a comprehensive test plan that includes:

- Clearly defined objectives and success criteria.

- Specific systems, IP addresses, and applications in scope.

- Authorized dates and times for testing to minimize operational disruption.

- Approved testing methods, tools, and reporting requirements.

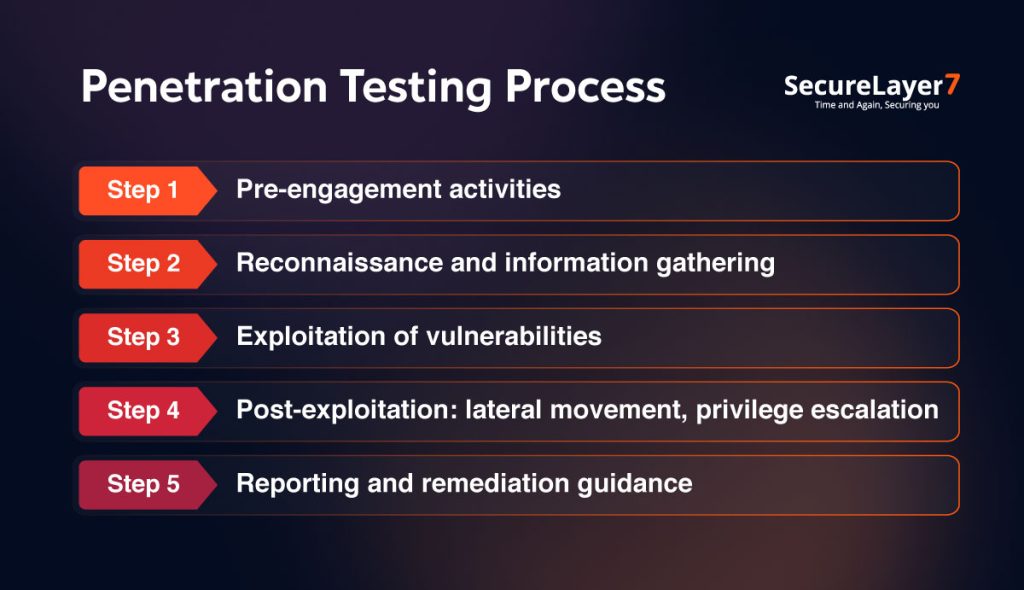

Penetration Testing Process

Penetration testing (pen testing) is a critical component of PCI DSS compliance, designed to identify vulnerabilities that malicious actors could exploit. Process simulates real-world cyberattacks to assess the security posture of systems that store, process, or transmit cardholder data.

The pen testing process typically involves planning and scoping, identifying and exploiting vulnerabilities, and then reporting findings along with remediation recommendations. Under PCI DSS, organizations must conduct both internal and external penetration tests at least annually and after any significant infrastructure or application changes to ensure continued protection of cardholder data.

Pre-engagement activities

Pre-engagement sets the foundation for any successful penetration test. During this stage, testers and stakeholders:

- Define the scope and objectives of the test (e.g., what systems or applications will be examined).

- Establish rules of engagement, ensuring both parties agree on boundaries, timelines, reporting expectations, and legal considerations.

- Decide on the testing approach black box (no prior knowledge), white box (full access), or gray box (limited information).

Reconnaissance and Information gathering

Reconnaissance is the intelligence-gathering phase where testers collect as much data as possible about the target:

- Discover publicly available information: domain names, IP ranges, employee data, technology stacks.

- Use OSINT (Open-Source Intelligence) methods: WHOIS lookups, search engine dorking, social engineering, network foot printing, and more.

- Differentiate between passive (no direct interaction) and active (direct probes or queries) reconnaissance.

Exploitation of Vulnerabilities

Testers move from observation to action:

- Leverage identified vulnerabilities – such as weak credentials, unpatched software, or misconfigurations – to gain unauthorized access.

- Employ various attack techniques, including SQL injection, cross-site scripting (XSS), or privilege abuse.

- Exploitation validates the presence and impact of vulnerabilities, demonstrating how real attackers might breach systems.

Post-exploitation: Lateral movement, Privilege escalation

With an initial foothold established, testers explore the true impact of a breach:

- Attempt lateral movement – expanding access to other systems or sensitive resources within the network.

- Perform privilege escalation by exploiting system weaknesses to gain higher access rights (e.g., moving from user to admin).

- Testers may also establish persistence (backdoors or access methods) to mimic advanced threat actors.

Reporting and Remediation guidance

The process concludes with documentation and actionable recommendations:

- Deliver a detailed report outlining vulnerabilities discovered, exploitation steps, data accessed, and business impact.

- Provide remediation guidance: prioritize security gaps, recommend fixes, and advise on enhancing policies and controls.

- Conduct a final debrief or meeting to clarify findings, answer stakeholder questions, and plan for risk mitigation.

Reporting and Remediation

Reporting and remediation follow a PCI DSS penetration test and focus on consolidating findings, analyzing vulnerabilities, and implementing corrective actions. Compliance, as well as security posture, needs to be maintained throughout the process.

Effective reporting will consist of an executive summary along with detailed findings, severity ratings, proof of exploit, and remediation recommendations. Organizations must address the remediation recommendations, verifying resolution through retesting. New documentation regarding these measures must also be prepared for PCI DSS assessors (QSAs) during audits for compliance verification.

What a PCI DSS pen test report must include

A PCI DSS-compliant penetration test report serves as a formal record of the testing process and findings. To meet the expectations of Requirement 11.4.5 (PCI DSS v4.0), the report must include the following key components:

- Executive Summary: A high-level overview of the test objectives, scope, and overall risk posture intended for non-technical stakeholders.

- Methodology: A description of the testing approach, including tools used, manual techniques, and compliance with industry-standard frameworks (e.g., NIST SP 800-115, OWASP Testing Guide).

- Scope of the Test: Clearly defined systems, networks, applications, and segmentation controls that were in-scope for testing.

How to Interpret Findings

Interpreting a penetration test report is critical for understanding the real-world risk to your cardholder data environment (CDE). Following is how to approach it:

- Look Beyond the Numbers: Don’t just focus on the number of vulnerabilities. Analyze which ones pose a significant threat to the confidentiality, integrity, or availability of cardholder data.

- Understand Business Impact: Prioritize findings based on potential operational disruption, financial loss, reputational damage, or regulatory consequences.

- Assess Exploitability: Consider how easily each issue can be exploited, whether it requires local access, or can be executed remotely with minimal effort.

- Segmentation Test Results: If segmentation was tested to isolate CDE from out-of-scope systems, verify that results support the integrity of those controls.

Prioritizing and Remediating issues

A structured approach to remediation ensures timely mitigation of risks and prepares your organization for revalidation:

- Classify Issues by Severity:

- Critical: Immediate remediation and temporary controls.

- High: Short-term remediation plan and increased monitoring.

- Medium: Planned remediation within a reasonable time frame.

- Low: Addressed as part of regular patch cycles.

- Assign Ownership: Each vulnerability should be assigned to a responsible team or individual with a defined timeline.

- Implement Fixes: Apply patches, reconfigure systems, or harden security controls based on the report’s recommendations.

- Retesting: Conduct a retest of previously identified vulnerabilities to ensure they have been resolved effectively, especially for high and critical issues.

Evidence and Documentation for the PCI DSS assessor (QSA)

QSAs require sufficient documentation to verify that penetration testing and remediation activities were executed in line with PCI DSS. This includes:

- Finalized Penetration Test Report: Updated to reflect any post-remediation retesting.

- Remediation Logs: Ticketing system exports, patch management logs, firewall rule changes, or configuration updates tied to specific vulnerabilities.

- Retest Results: If applicable, a separate report or addendum indicating the resolution status of each finding.

Choosing the Right Penetration Testing Provider

Choosing the correct provider for penetration testing is important not just for fulfilling PCI DSS compliance but also ensuring that the security assessment in question is effective. The provider selected must hold the necessary technical skills, certifications in the industry, as well as sufficient relevant experience to conduct proper and compliant tests.

Companies are encouraged to engage with someone holding the status of a Qualified Security Assessor (QSA) or an Approved Scanning Vendor (ASV) since they are recognized by the PCI Security Standards Council. Aside from certifications, look into the provider’s methodology, the quality of their reports, and how well they know your industry.

PCI DSS Qualified Security Assessors (QSAs) vs. other providers

One of the most common points of confusion is the difference between Qualified Security Assessors (QSAs) and penetration testing providers. Following is the breakdown to clarify their roles:

- QSAs: These are professionals certified by the PCI Security Standards Council (PCI SSC) to perform official PCI DSS assessments. While some QSAs may offer penetration testing services, not all do.

- Penetration Testing Providers: These may or may not be QSAs. What’s important is whether they understand and adhere to the PCI DSS guidelines (specifically, Requirement 11.4.5 of PCI DSS v4.0). A non-QSA provider can still be a valid choice – if they demonstrate technical expertise, experience in testing cardholder data environments (CDE), and familiarity with segmentation controls.

Traits of a good pen testing firm

Choosing a penetration testing firm involves more than comparing pricing or looking for big names. Following are the essential traits to look for:

- Relevant Experience: Look for firms with deep experience in testing environments similar to yours – especially those that handle retail, e-commerce, financial, or healthcare systems.

- Familiarity with PCI DSS: The firm should understand how PCI DSS applies to your systems, including segmentation testing and CDE boundaries.

- Certified Experts: Their team should include certified professionals such as OSCP, CEH, GPEN, or CREST-certified testers.

Questions to ask vendors before hiring

Selecting a vendor shouldn’t be a blind trust exercise. Following are key questions to ask before committing:

- Have you conducted PCI DSS-compliant pen tests before?

- Do you follow industry standards like NIST SP 800-115 or OWASP?

- Can you provide sample reports or sanitized case studies?

- What certifications do your testers hold?

Common Pitfalls to Avoid

Even with the best intentions, organizations often make mistakes during the PCI DSS penetration testing process that can jeopardize compliance and leave systems vulnerable. Recognizing and avoiding these common pitfalls is essential for conducting effective and meaningful security assessments.

Typical mistakes include setting an incomplete test scope, relying solely on automated tools instead of manual testing, failing to document findings clearly, and neglecting to retest after remediation. Oversights can lead to undetected vulnerabilities and non-compliance with PCI DSS requirements.

Incomplete scope

A penetration test is only as effective as the scope defined. One of the most frequent mistakes is scoping too narrowly, often excluding critical systems, third-party integrations, or internal environments that interact with cardholder data.

Why it matters: PCI DSS Requirement 11.4.5 emphasizes the importance of testing all systems and segmentation controls within the cardholder data environment (CDE).

How to avoid it:

- Conduct a thorough asset inventory and data flow analysis before the test.

- Include all systems that store, process, or transmit cardholder data – and those that have access to them.

- Don’t forget segmentation testing if you’re relying on it to reduce PCI scope.

Using automated scans only

Relying solely on automated vulnerability scanners is a major shortfall in penetration testing. While these tools are helpful for identifying known issues, they cannot replace the human expertise required to exploit and assess vulnerabilities in context.

Why it matters: Automated scans can’t test business logic flaws, chained vulnerabilities, or simulate real-world attacker behavior. PCI DSS mandates a manual, methodical approach that mimics actual attack vectors.

How to avoid it:

- Ensure your provider performs both automated and manual testing.

- Choose a vendor with skilled testers who can validate and exploit findings responsibly.

- Confirm that the testing methodology includes reconnaissance, exploitation, and post-exploitation analysis.

Poor documentation

The penetration test is only useful if it’s properly documented. Incomplete, unclear, or overly technical reports can lead to misunderstandings and compliance failures, especially when reviewed by your QSA (Qualified Security Assessor).

Why it matters: A PCI DSS-compliant report must contain clear findings, risk ratings, remediation steps, and evidence of exploitation. Vague documentation can lead to unnecessary back-and-forth with assessors or, worse, test invalidation.

How to avoid it:

- Review sample reports before hiring a testing provider.

- Ensure your report includes an executive summary, detailed findings with impact analysis, remediation guidance, and retesting status.

- Confirm that documentation aligns with PCI DSS requirements and includes segmentation validation, if applicable.

Not Retesting after Remediation

One of the biggest compliance gaps occurs when organizations remediate vulnerabilities but fail to validate the fix. Results in unresolved risks and non-compliance with PCI DSS requirements.

Why it matters: PCI DSS requires proof that critical and high-risk vulnerabilities identified during penetration testing have been re-tested and resolved before submission to the QSA.

How to avoid it:

- Build retesting into your remediation plan and timeline.

- Request a follow-up report from your pen testing provider confirming issue closure.

- Provide your QSA with both the original findings and the retest results.

PCI DSS 4.0: What’s New for 2025

Version 4.0, effective from April 1, 2025, marks a significant shift toward continuous security and risk-based thinking. The update introduces new technical requirements, enhanced authentication standards, and greater flexibility in how organizations achieve compliance through the Customized Approach.

The goal of PCI DSS 4.0 is to modernize payment data security, address emerging threats like client-side attacks, and ensure that security practices are integrated into daily operations – not just assessed once a year. Understanding these changes is essential for businesses aiming to stay compliant and secure in 2025 and beyond.

Key updates to Penetration testing requirements

Penetration testing continues to be a cornerstone of PCI DSS compliance, but version 4.0 introduces several critical enhancements that organizations must be aware of:

- Expanded Testing Frequency and Triggers: While annual penetration testing remains a baseline requirement, PCI DSS 4.0 now emphasizes event-based testing. Organizations must perform pen tests not just on a scheduled basis, but also after any significant changes in the network, applications, or infrastructure.

- Improved Methodology Standards: The updated standard now mandates that penetration tests align with industry-recognized methodologies such as NIST SP 800-115 or the OWASP Testing Guide. Testers must provide detailed documentation of scope, tools, findings, and remediation efforts.

- Clearer Internal vs. External Test Requirements: PCI DSS 4.0 outlines stricter criteria for internal testing, ensuring that all internal systems within the cardholder data environment (CDE) are thoroughly evaluated – not just perimeter defenses.

Changes in segmentation testing

Segmentation testing helps demonstrate that networks are properly isolated and that only the designated cardholder data environment is subject to PCI DSS controls. Under version 4.0, segmentation testing has seen the following changes:

- Stricter Validation Criteria: Testers must now prove that segmentation controls (like firewalls, VLANs, or access control lists) effectively prevent unauthorized access to the CDE.

- Documentation and Evidence Requirements: Organizations must provide comprehensive documentation on their segmentation architecture and testing results. Includes network diagrams, firewall rules, and access control configurations reviewed during the test.

- Qualified Tester Expectations: Testing must be performed by qualified individuals with proven expertise in segmentation validation, which may include internal security teams or third-party assessors.

Emerging threats to consider (cloud, APIs, third parties)

Cyber threats are constantly evolving, and PCI DSS 4.0 reflects this by urging organizations to consider a broader range of modern attack vectors during their testing and risk assessment processes. Key areas of concern include:

- Cloud Security Risks: As more businesses move to cloud-based environments, the attack surface expands. Misconfigured storage buckets, weak API keys, and insecure container images are frequent issues.

- API Vulnerabilities: APIs are increasingly used for payment processing, data exchange, and integrations. They often lack proper authentication and input validation.

- Third-Party and Supply Chain Risks: Vendors and third-party providers with access to the CDE or sensitive data are a growing concern. PCI DSS 4.0 pushes organizations to evaluate third-party access, data-sharing policies, and incident response plans to address supply chain vulnerabilities.

Best Practices and Tips

Achieving and maintaining PCI DSS compliance goes beyond passing an annual assessment – it requires a proactive and strategic approach to security. Implementing best practices ensures that your systems are resilient, your data is protected, and your compliance efforts are sustainable.

Tips for integrating penetration testing into your broader security strategy, fostering a mindset of continuous improvement, and building an incident response plan that turns test findings into actionable safeguards. The best practices not only support compliance but also strengthen your organization’s overall cybersecurity posture.

Integrating pen tests into broader security strategy

Many organizations treat penetration tests as a checkbox for compliance. To get the most out of these exercises, they should be deeply embedded into your overarching cybersecurity program. Following is how:

- Align Testing with Business Goals: Pen tests should be aligned with key business priorities – such as protecting sensitive customer data, maintaining service availability, and ensuring compliance with regulations like PCI DSS or HIPAA.

- Test Across Layers: Don’t limit tests to external perimeters. Include internal systems, APIs, mobile apps, cloud environments, and third-party integrations. A layered approach ensures comprehensive visibility.

- Leverage Pen Test Results for Risk Management: Use test findings to inform enterprise risk management (ERM) activities. Prioritize vulnerabilities based on business impact, not just severity scores.

Continuous improvement mindset

Security is not a one-time effort. Cyber threats evolve, and so should your defense mechanisms. A continuous improvement mindset helps organizations stay ahead:

- Perform Regular and Trigger-Based Testing: Schedule annual tests but also perform them after major changes – like system upgrades, new deployments, or infrastructure modifications.

- Track Metrics and Trends: Maintain historical data from previous pen tests. Analyze trends over time to understand how your security posture is improving or where regressions are occurring.

- Close the Feedback Loop: Ensure that test findings are not just logged, but acted upon. Create remediation workflows with owners, deadlines, and verification steps to ensure every issue is addressed.

Building an incident response plan tied to pen test results

Penetration tests often reveal more than vulnerabilities – they highlight gaps in detection, response, and recovery. Use your pen test insights to strengthen your Incident Response Plan (IRP):

- Simulate Real-World Scenarios: Use the findings from pen tests to design tabletop exercises and red team-blue team simulations.

- Refine Detection and Alerting: If a pen test exploited a vulnerability without triggering alerts, it’s a sign that your monitoring systems need to be adjusted. Review and fine-tune your SIEM or EDR tools accordingly.

- Enhance Playbooks: Update your incident response playbooks to reflect the attack paths discovered during pen tests.

Conclusion

Effective penetration testing is not just a checkbox for PCI DSS compliance – it’s a vital defense mechanism against evolving cyber threats. As PCI DSS 4.0 ushers in stricter standards and continuous security expectations, organizations must ensure their systems are regularly and rigorously tested.

To stay compliant in 2025 and beyond, businesses should adopt a proactive testing strategy, address vulnerabilities swiftly, and maintain detailed documentation for QSA audits. Don’t leave your compliance to chance – partner with experts who understand the intricacies of PCI DSS.

SecureLayer7 offers industry-leading penetration testing services tailored for PCI DSS requirements. Our certified professionals combine deep security expertise with cutting-edge tools to help you uncover vulnerabilities before attackers do.

Schedule your PCI DSS penetration test with SecureLayer7 today and ensure your business stays secure and compliant.

Frequently Asked Questions (FAQs)

Yes. PCI DSS requires both internal and external penetration tests to ensure the security of your cardholder data environment (CDE).

• External penetration tests evaluate how an attacker could gain access from outside your network (e.g., via the internet).

• Internal penetration tests assess risks that could come from within your organization’s network, such as from a compromised user or malicious insider.

Significant changes refer to any updates in the environment that could impact the security posture of the CDE. Examples include:

• Deployment of new systems, applications, or services.

• Network topology changes (e.g., adding/removing firewalls, routers).

The cost can vary based on multiple factors such as:

• Scope and size of your environment.

• Whether you need both internal and external testing.

You may perform penetration testing in-house if your internal team:

• Is independent of the systems being tested.

• Has documented qualifications and demonstrated proficiency.

• Follows industry-recognized methodologies like OWASP or NIST.